This past week about 360 of 500 companies in the S&P 500 have reported 4th quarter corporate earnings about 5% higher than the year earlier period. This exceeded analysts estimates of 3.2% as predicted at the end of 2016. Stocks, entering the 8th year of a bull market, have continued to rise since Donald Trump’s surprise election win on expectations of tax cuts, regulatory relief, reinvestment in US infrastructure and a promise to restore lost US manufacturing jobs.

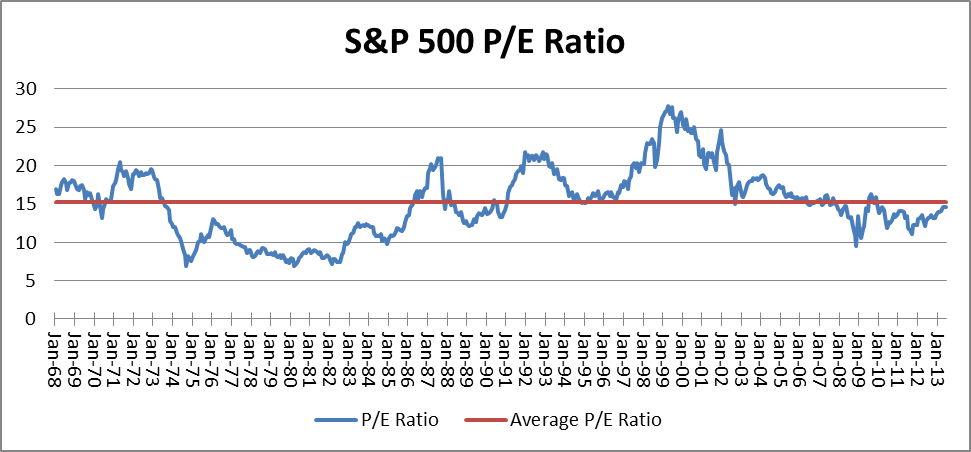

The S&P 500 PE ratio (Price/Earnings ratio – a measure of stock market valuation) stands today at a lofty 26, quite a bit higher than the long term average PE ratio of 17. A drop in the market is not only inevitable but provides an entry point for the opportunistic investor.

The Wall Street Journal cites the research of Strategas Research Partners who observed there have been 21 separate pullbacks of at least 10% in the S&P 500 since 1987’s Black Monday. The average drop during these market retreats was 19% and have lasted about 3 months.

The recovery, however, is equally impressive. With the exception of one time, all pullbacks were followed by a more than 10% gain in the S&P 500 within three months with an average gain of 16%.

Most investors allow fear and emotions to take over during bear markets, sell in a falling market, and go to cash. They almost certainly will miss the bounce. Downturns are an opportunity to sell losers, offset taxable gains with losses, and reallocate to areas of strength and undervaluation. This is part of the discipline that is expected of asset allocators and professional money managers.